-

Kupfer-Nickel-Legierungen29 63.546Cukupfer28 58.6934Ninickel

-

Spinodal-Legierungen Kupfer-Nickel-Zinn29 63.546Cukupfer28 58.6934Ninickel50 118.71Snzinn

-

Kupfer-Nickel-Silizium (oder Silizium-Bronze-) Legierungen29 63.546Cukupfer28 58.6934Ninickel14 28.0855Sisilicium

-

Spezial-Aluminium-Bronze29 63.546Cukupfer13 26.9815386Alaluminium

-

Reines & niedrig legiertes Kupfer29 63.546Cukupfer

-

Kupfer-Beryllium-Legierungen29 63.546Cukupfer4 9.012182Beberyllium

-

Reines Nickel & Nickel-Superlegierungen28 58.6934Ninickel

-

Spezielles Nickel-Silber29 63.546Cukupfer30 65.409Znzink28 58.6934Ninickel

-

Kupfer-Mangan-Legierungen29 63.546Cukupfer25 54.938045Mnmangan

-

Messing (verbleit & bleifrei)29 63.546Cukupfer30 65.409Znzink

-

Antimikrobielles Kupfer29 63.546Cukupfer

-

Bronze (Zinnbronze)29 63.546Cukupfer50 118.71Snzinn

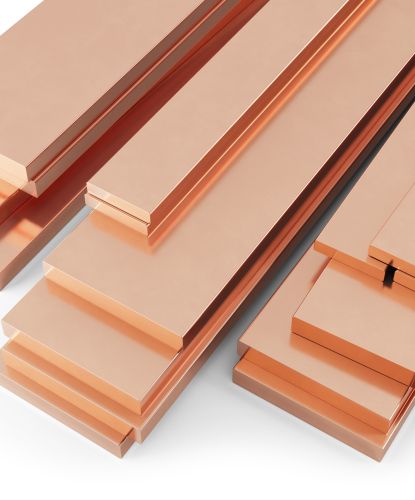

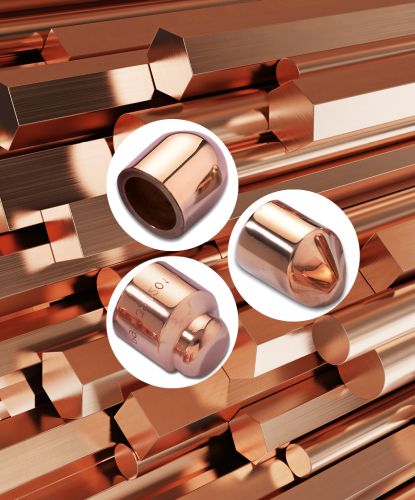

Produkte

-

Kupfer-Nickel-Legierungen29 63.546Cukupfer28 58.6934Ninickel

-

Spinodal-Legierungen Kupfer-Nickel-Zinn29 63.546Cukupfer28 58.6934Ninickel50 118.71Snzinn

-

Kupfer-Nickel-Silizium (oder Silizium-Bronze-) Legierungen29 63.546Cukupfer28 58.6934Ninickel14 28.0855Sisilicium

-

Spezial-Aluminium-Bronze29 63.546Cukupfer13 26.9815386Alaluminium

-

Reines & niedrig legiertes Kupfer29 63.546Cukupfer

-

Kupfer-Beryllium-Legierungen29 63.546Cukupfer4 9.012182Beberyllium

-

Reines Nickel & Nickel-Superlegierungen28 58.6934Ninickel

-

Spezielles Nickel-Silber29 63.546Cukupfer30 65.409Znzink28 58.6934Ninickel

-

Kupfer-Mangan-Legierungen29 63.546Cukupfer25 54.938045Mnmangan

-

Messing (verbleit & bleifrei)29 63.546Cukupfer30 65.409Znzink

-

Antimikrobielles Kupfer29 63.546Cukupfer

-

Bronze (Zinnbronze)29 63.546Cukupfer50 118.71Snzinn

- Hardiall® Sortiment an spinodalen Legierungen

- Niclafor® 1000 | CuNi9Sn6 | C72700

- Declafor 1015 | CuNi7.5Sn5Te | C72670

- NS30 | CuNi7Si2Cr

- ARCAP®

- K5 & K5B Nickel-Aluminium-Bronzen

- K7 | CuNi14Al3Fe1 | WL 2.1504 | LN 9468

- Hardibron® | CuNi14Al3Fe1 | WL 2.1504 | DTD 900/4805

- Navinic

- C63000 & AMS4590 Kupferlegierungen

- Schweißelektroden und Schweißlegierungen: Powerode+® & Alrode®

- Schweißen von Kupferlegierungen in Stangen und Coils

- UC500 | CuCrZr | ASTM B624

- C97® & C98® spezielles niedrig legiertes Kupfer

- C99® spezielles niedrig legiertes Kupfer

- Si45Z | CuSi3Fe2Zn3 | C65620 | AMS 4616

- Reines Nickel

- EnviB X

- Alrode® | CuCrZr | C18147

- Niclal® 43A | CuMn12Ni | CuMn12Ni2

- AB2 | CuAl10Ni | C95800

- Alloy 954 | CuAl10Fe3 | C95400 | CC331G

- PB1 | CuSn10P | C90700

- LG2 | CuSn5Zn5Pb5 | CC491K

- AMS 4880 | CuAl11Ni5Fe5 | C95510

- AMS 4881 | CuAl10Ni5Fe3 | C95520

Kernprodukte

- Hardiall® Sortiment an spinodalen Legierungen

- Niclafor® 1000 | CuNi9Sn6 | C72700

- Declafor 1015 | CuNi7.5Sn5Te | C72670

- NS30 | CuNi7Si2Cr

- ARCAP®

- K5 & K5B Nickel-Aluminium-Bronzen

- K7 | CuNi14Al3Fe1 | WL 2.1504 | LN 9468

- Hardibron® | CuNi14Al3Fe1 | WL 2.1504 | DTD 900/4805

- Navinic

- C63000 & AMS4590 Kupferlegierungen

- Schweißelektroden und Schweißlegierungen: Powerode+® & Alrode®

- Schweißen von Kupferlegierungen in Stangen und Coils

- UC500 | CuCrZr | ASTM B624

- C97® & C98® spezielles niedrig legiertes Kupfer

- C99® spezielles niedrig legiertes Kupfer

- Si45Z | CuSi3Fe2Zn3 | C65620 | AMS 4616

- Reines Nickel

- EnviB X

- Alrode® | CuCrZr | C18147

- Niclal® 43A | CuMn12Ni | CuMn12Ni2

- AB2 | CuAl10Ni | C95800

- Alloy 954 | CuAl10Fe3 | C95400 | CC331G

- PB1 | CuSn10P | C90700

- LG2 | CuSn5Zn5Pb5 | CC491K

- AMS 4880 | CuAl11Ni5Fe5 | C95510

- AMS 4881 | CuAl10Ni5Fe3 | C95520

- Strommessung & Präzisions-Widerstandslegierungen

- Akku-Materialien

- Verkabelung für hohe Leistungen

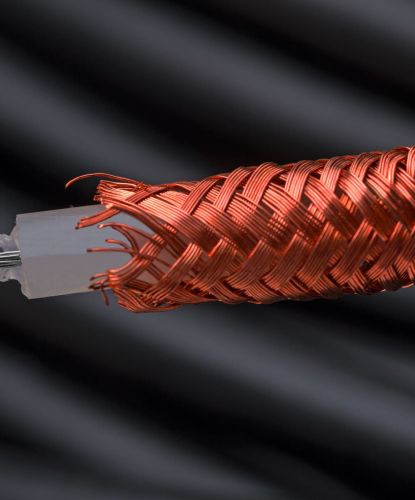

- Elektromagnetische Abschirmung

- Hochdruckfeste, thermisch wirksame, reibungsverschleißfeste Komponenten

- Mechanische Hochleistungskomponenten für die Luft- und Raumfahrt

- Hochleistungskomponenten für den Ventiltrieb

- Komponenten für Meerwasserkreisläufe mit hoher Korrosionsbeständigkeit

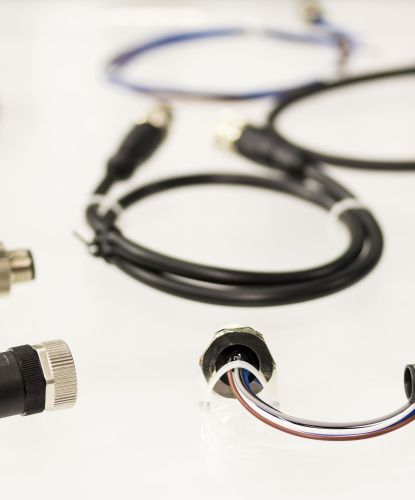

- Elektrische Steckverbinder

- Glasfaser-Steckverbinder

- Komponenten für die Eisenbahnindustrie

- Hoch belastbare, reibungsverschleißfeste Komponenten

- Korrosionsbeständige Komponenten für hohe Drücke und hohe Temperaturen (HPHT)

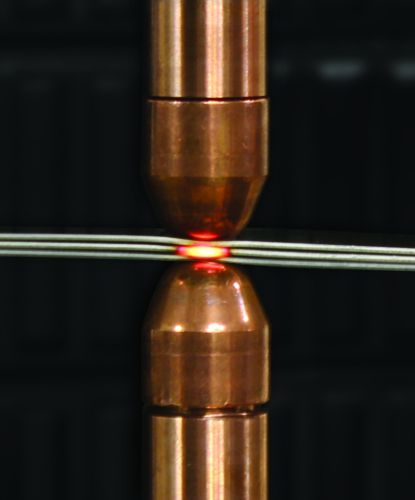

- Widerstandsschweißlösungen

- Elektromotoren & Generatoren: Materialien mit hoher Leitfähigkeit und hoher Festigkeit

- Wasserstoff & Energie: hochfeste, korrosions- und druckbeständige Komponenten

Anwendungen

- Strommessung & Präzisions-Widerstandslegierungen

- Akku-Materialien

- Verkabelung für hohe Leistungen

- Elektromagnetische Abschirmung

- Hochdruckfeste, thermisch wirksame, reibungsverschleißfeste Komponenten

- Mechanische Hochleistungskomponenten für die Luft- und Raumfahrt

- Hochleistungskomponenten für den Ventiltrieb

- Komponenten für Meerwasserkreisläufe mit hoher Korrosionsbeständigkeit

- Elektrische Steckverbinder

- Glasfaser-Steckverbinder

- Komponenten für die Eisenbahnindustrie

- Hoch belastbare, reibungsverschleißfeste Komponenten

- Korrosionsbeständige Komponenten für hohe Drücke und hohe Temperaturen (HPHT)

- Widerstandsschweißlösungen

- Elektromotoren & Generatoren: Materialien mit hoher Leitfähigkeit und hoher Festigkeit

- Wasserstoff & Energie: hochfeste, korrosions- und druckbeständige Komponenten